SAP S/4HANA Finance, also known as SAP S4 Finance or SAP Simple Finance, is the name of the next generation of FI/CO in SAP. S/4HANA Finance is the SAP response to today’s demands for fast, coordinated and detailed financial reporting. Mercoline supports you along the way to SAP S/4HANA Finance, no matter the finance system you choose.

S/4HANA Finance at a glance

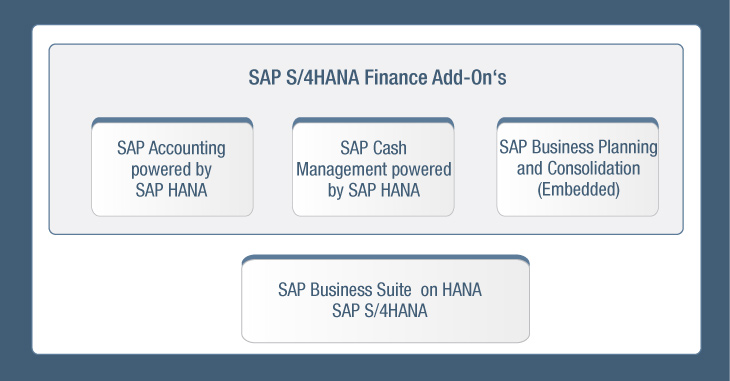

S/4HANA Finance is based on three pillars:

- SAP Accounting: Master and transaction data can be analysed across applications. Via the applications “Finance”, “Controlling”, “Asset Accounting”, and “Materials Management”, the account presents the leading, and therefore most important, element.

- SAP Cash Management: Liquidity analyses can be evaluated in relation to applicable cut-off dates using finance data that has already been accounted for or planned finance data.

- Integrated planning: The components Business Planning and Consolidation (BPC) make it possible to register and process planned and forecast values directly in the SAP ERP.

New features and benefits

Single source of truth

- One table containing all necessary information

- Switch from a dual-circuit system to a single-circuit system

- Highest level of data granularity and harmonisation

- Eliminates the need for coordination between FI and CO

- Flexible reporting made easy

Real-time FI support

- Asset management is moved directly into the general ledger, producing real documents in real time

- FI posts flow immediately into the financial statement, i.e., the “daily soft closing”

- Accelerated financial statements: Finance data from several SAP systems or non-SAP systems are merged in S/4HANA

Dynamic CO plans and analyses

- Altered master data model, e.g., partner master data (business partners)

- No more cost categories; accounts are all general ledger accounts (including secondary cost categories)

- Account-based profitability analysis possible, including cost allocation of sales and production variances

- Embedded analytics: Reporting tools from SAP BW in real time in SAP ERP

- BPC embedded: Planning tools are also available in ERP

Whatever challenge you face, Mercoline is there to help.

Here’s how Mercoline supports you in the migration to SAP S/4HANA Finance:

1. Creating an overview

2. Stocktaking

3. Decision-making

4. Implementation

- Preparation for migration

- Installation

- Customisation

- Data migration

- Tests and going live