M.SecureTrade VAT Number Check

Check the accuracy of VAT ID numbers directly in your SAP system

Since 1 January 2010, VAT exemption for goods deliveries to foreign EU countries requires that the company supplying the goods in question check the recipient company's VAT Identification Number (VAT ID No.). M.SecureTrade VAT Number Check helps you fulfill the obligation to check VAT ID numbers and subsequently reduces risks your company may face.

The solution at a glance

SAP-integrated verification of validity of the VAT Number

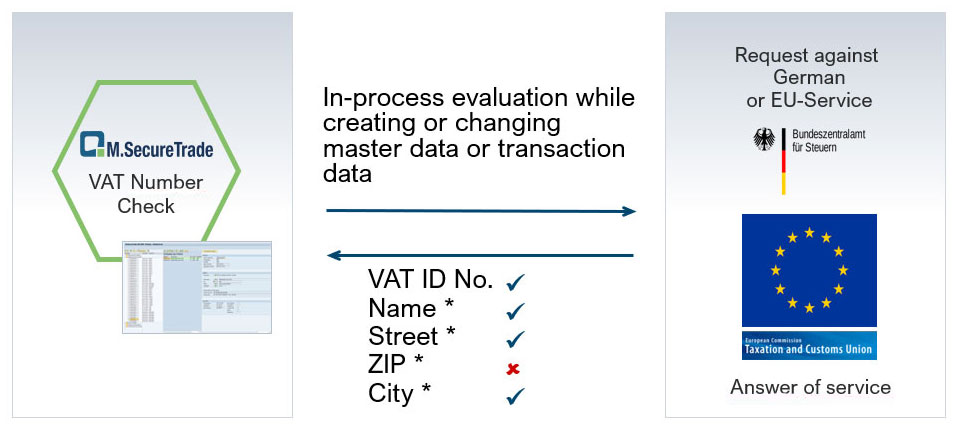

- Automatically checks the accuracy of VAT ID Numbers, e.g. in invoices or orders, against lists from the German Federal Central Tax Office (BZSt) and/or the EU (VIES)

- Enables both a simple check and a qualified check (for instance, with the address data of the recipient, BZSt only, etc.)

Support of different check requirements

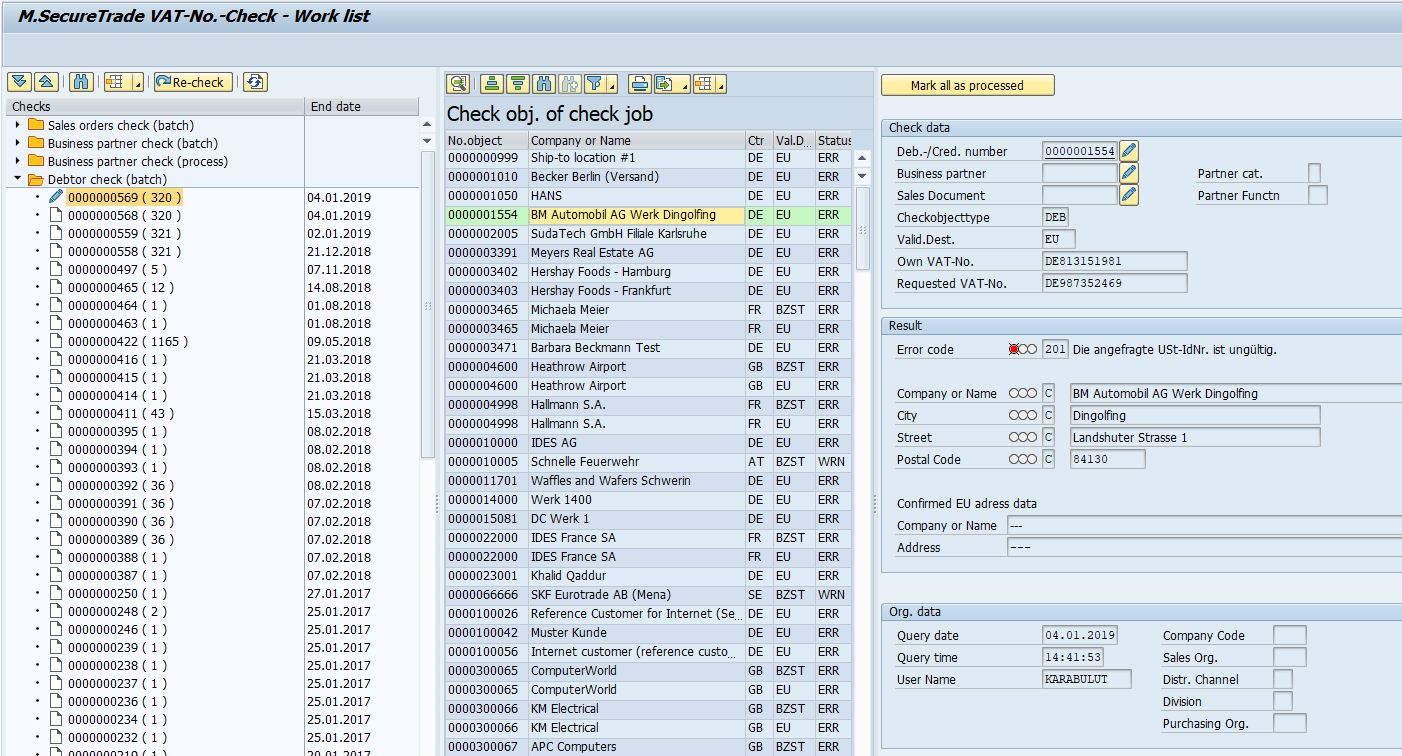

- Mass data checks for existing master data and and transaction data, such as customers, vendors, business partners, sales orders, deliveries, etc.

- Process check when master data and transaction data are generated and changed (e.g. debitor, creditor, sales orders)

- Additional manual checks or batch checks for existing master data

Comprehensive monitoring and logging of all check results

- Viewing and editing hits in the worklist

- Batch job logs with all results from mass data checks

- Filing of the confirmation from the German Federal Central Tax Office into the log book

Fully integrated in SAP

- No modification required thanks to the use of an independent SAP namespace

- Using the familiar SAP user interface and the SAP authorization concept

- Implemented quickly and adapted to meet your individual needs

- SAP archiving capability

Your benefits at a glance

Reduction of the risks of value-added tax back claims

- Checks both at the beginning of a business partner's life cycle and continuously in sales documents

- Proof of the checks carried out at all times

Relief for employees

- Can be operated immediately thanks to the use of your accustomed SAP user interface

- Automated checks reduce your staff’s workload

High traceability of verification and results

- Completed checks are securely logged in your SAP system

- Manual VAT ID No. check possible

Quick implementation of the solution

- Complete integration into your SAP processes, as the application is based on SAP technologies

- Potential for customisation

All Mercoline solutions can also be used in the subscription model.

Reference story: Cloos uses the solution for VAT number check

Objective:

Error-free fulfillment of all legal requirements for checking VAT numbers

Highlights:

- Implementation within a few days

- no time-consuming user training

- at the request of Cloos, no connection of the SAP system to the Internet

"The software to be used should fully meet the legal requirements and be able to document the results in an audit-proof manner. The VAT ID check should also be able to be 100% integrated into the existing SAP system."

Ralf Pfeifer, head of IT and organization at Cloos

![[Translate to englisch:] Krieg in der Ukraine und Außenhandel: das müssen Sie jetzt wissen](/fileadmin/images/blog/blog-sanktionslisten-russland.jpg)