Quick Fixes as of 2020: The start of the EU’s major VAT reform

The EU is set to introduce integrated VAT reform between 2022 and 2024. To ensure greater clarity until then regarding chain transactions, intra-EU transfers and consignment stores, “Quick Fixes” took effect on January 1st, 2020.

USTID check as a material prerequisite for tax exemption

Effective as of Jan. 1st, 2020, logging of the buyers’ (delivery) valid VAT identification numbers (VAT ID No.) and the correct submission of a recapitulative statement (RS) are express prerequisites for tax exemption on intra-EU deliveries. This means that failure by the supplier to log a buyer’s valid VAT ID No. will make the intra-EU delivery compulsorily subject to taxation. The following material preconditions must be checked or implemented for every EU delivery:

- The buyer’s VAT ID is on hand.

- The buyer is registered for VAT in a different EU member state than the one from which the shipment originates.

- The VAT ID is logged in the MIAS system (also known as the VIES system).

- The delivery is correctly compiled.

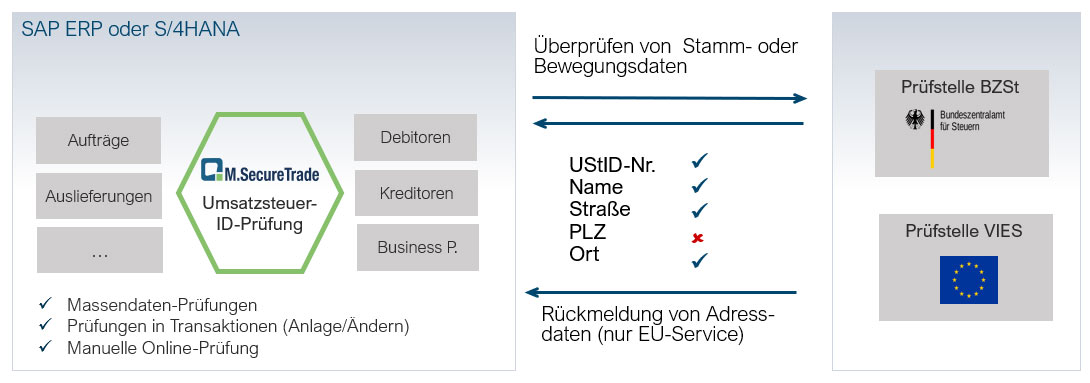

Use M.SecureTrade VAT ID Check to comply with the new requirements

With help from M.SecureTrade VAT ID Check and the implementation of SAP standard processes, the stricter requirements discussed above can be complied with fully.

- Qualified check (with the buyer’s address data)

- Crosschecks with various inspection bodies (DE-BZSt, EU-VIES)

- Master data check (debtors, creditors, business partners)

- Transactional data check (orders, shipments)

- Comprehensive logging of the checks

- Consultation on the implementation of the recapitulative statement in SAP

Audit Processes in M.SecureTrade VAT ID Check