Save with qualified electronic signature

On January 1st, 2002, the German tax authorities also began accepting electronic invoice vouchers for input tax deduction on the condition that such EDI invoices bear a qualified electronic signature. Our solution is called CS.eSignature.

This attractive signature service package from Mercoline reduces company invoicing costs quickly, without you even having to make any investment. Mercoline supplies you with your own infrastructure.

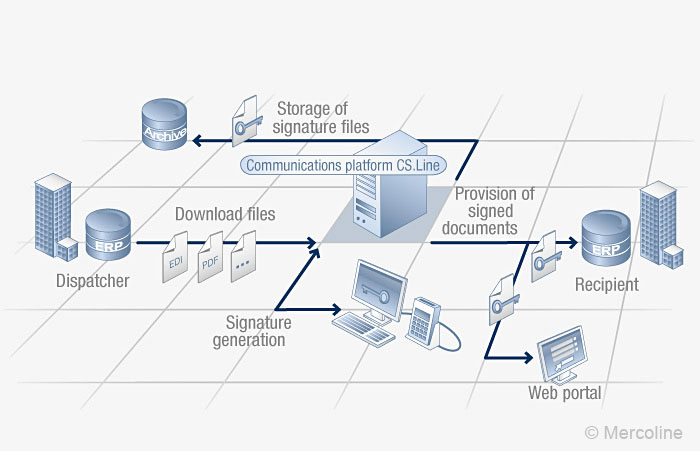

Dispatch Outbox

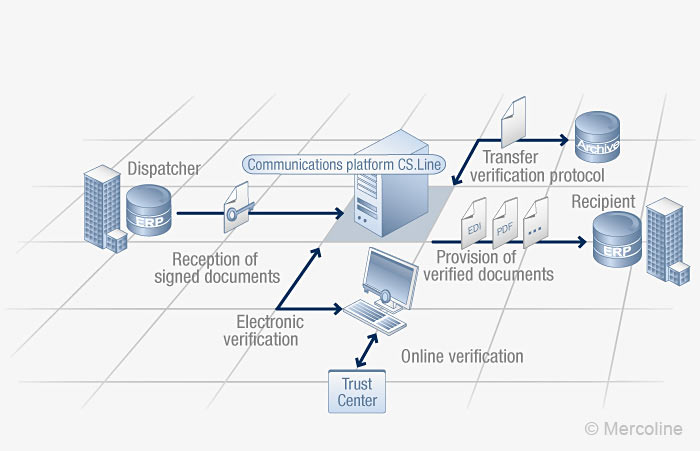

Signature Inbox

The qualified electronic signature is then later inspected, verified and saved together with the invoice by the recipient. Mercoline provides customers with an efficient eSignature infrastructure.

CS.eSignature comprises ...

- full-service provision for signing and verifying invoices or other documents

- the safeguarding of all identification, closing and evidentiary functions

- the support of all common formats for the digital signature of PKCS#7 signed-data and PKCS#7 S/MIME, for instance: *.pdf, *.pk7, *.p7s, *.p7m, *.dgs and 2-D barcode signature

- the provision of the signature and verification files for entry and archiving in bookkeeping and ERP systems

ML_Folder_CS_Line_en.pdf

Product folder CS.Line

Benefits for invoice transmitters:

- fast ROI from the high cost-savings potential

- low risk, since no investment costs are required

- 100% non-paper procedure eliminating media disruptions in the transmission of invoice data

- the complete legal security of the procedure, comparable with the legal security of a handwritten signature

- the highest level of security against forgeries in sending invoices

Benefits for invoice recipients:

- faster ROI from the high cost-savings potential

- low risk, since no investment costs are required

- data import into ERP systems without media disruptions

- input tax deduction with electronic invoices in accordance with §14 of the UStG (German sales tax law)

- simple distribution throughout the company (for instance to the ordering department for auditing)